Has The Market Taken Technology Too Far?

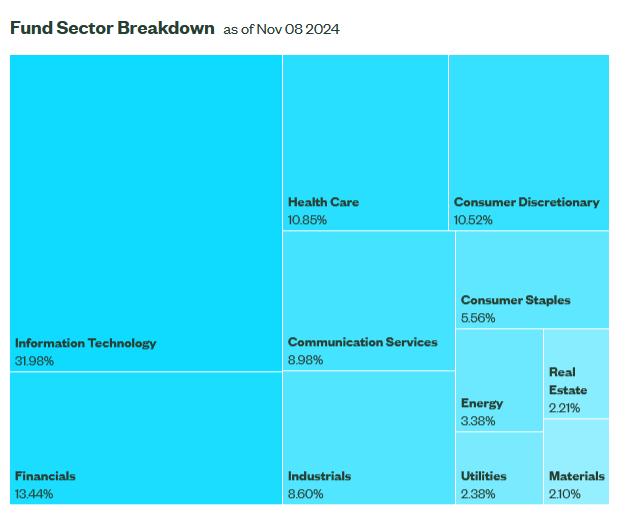

If we take a look at SPY currently technology is 32% of the index. We have had a boom in the past couple years with AI, big data, the internet but I think there are some big bumps in the road. No party lasts forever. Valuations are high and the market has become very concentrated in technology.

SPY Sector Concentration

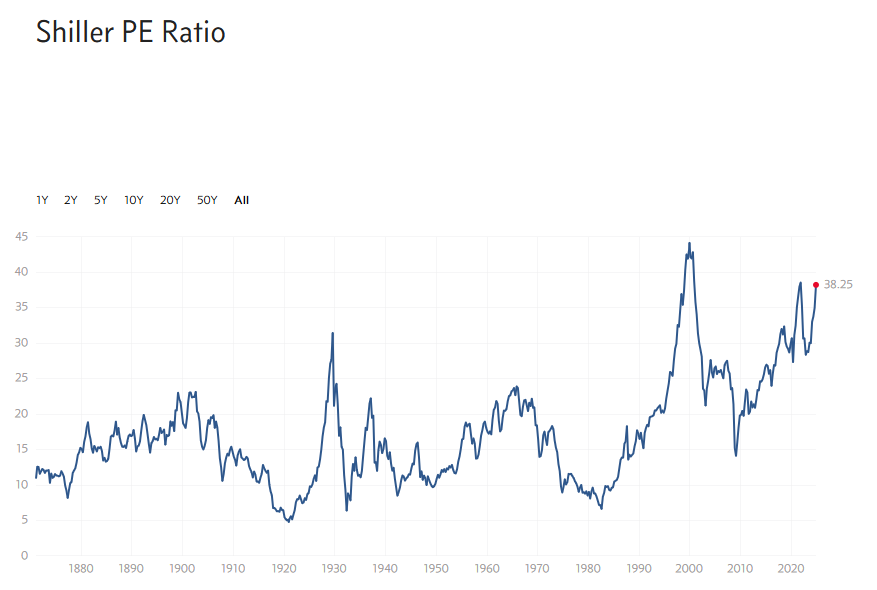

Case PE Ratio

Long Term Projected Returns

10 year expected US equity returns are not looking too hot, especially compared to other asset classes. Goldman expects a miniscule 3% annualized nominal return for U.S. equities over the next decade. Other analyst groups like Vanguard foresee higher returns (~6%), but that is still not that much better. At this point a traditional 60% stocks / 40% bonds looks like a tough sell.

Active vs Passive - or Somewhere Inbetween?

The standard wisdom is its best to be a simple passive long term investor, unless you want to turn your portfolio into a casino fund. That view made sense in the past couple decades as the U.S. empire expanded throughout the globe, opened up new markets, interest rates fell, valuations increased and high technology took over. A rising tide lifts all boats; one didn't have to do much to sit back and enjoy the rewards.

Today the world is a different place. Developing nations continue to grow while developed western nations struggle to find a new growth engine. Now is a great time to consider taking a slightly active approach to investing. Maybe a 40% equities, 30% bonds and 20% real estate portfolio with annual rebalancing?

*Information is provided here for educational purposes only.